how much tax is taken out of my paycheck in san francisco

And no its not COVID-19. The amounts taken out of your paycheck for social security and medicare are based on set rates.

Do you know whether you should claim 0 or 1 on your tax form.

. The tax filing service TurboTax has teamed up with Coinbase to allow its customers to have their tax refunds automatically deposited into a Coinbase account and immediately converted to cryptocurrency the crypto company said in a blog post Thursday. San Francisco recalls 3 members of citys school board. This means many Americans pay federal state and local income taxes and the rates vary a great deal.

Homelessness emerged as a national issue in the 1870s. As a young adult its never too early to better understand tax tips for teensIf your teen earned a paycheck from a summer job or an after-school gig be sure to go over these teen tax tips to kick off the family discussion about teen taxes. Overall the effective tax rate on high incomes fell by 7 during the Clinton presidency and 6 in the Bush era so the top 400 had a tax rate of 20 or less in 2007 far lower than the marginal tax rate of 35 that the highest income earners over 372650 supposedly pay.

WAGE CLAIMS 2021 Studies show that as many as 4 out of 5 employees are the victims of wage theftIf your employer owes you money you have the right to immediately file a labor board complaint against your employer and have your case heard by a California Labor Commissioner-appointed judge. Paycheck Amount biweekly. I limit how much work I do for free which means I havent made many open-source contributions lately.

He was able to fix it and said I should be getting paid in 24-48 hours. The great thing about a 401k is that you are contributing witth pre-tax money. The controversial tax will not be taken out of paychecks in the meantime.

Jurors in a San Francisco federal court awarded former Tesla Inc. Theres now a new way to spend your tax refund. The cost of new housing construction is 220sqft4 or 200K for the same size house.

More than 10 million worth of precious personal protective equipment -- purchased with your tax. Id love to have a path to cover my living expenses while doing more open-source work. The reduced tax rate saves them 5720 in taxes this year.

And many teenagers find out the hard way that paying taxes is a. Legal-Courts Hillarys campaign paid for high-tech spying on Trump even after the election says Durham. Jacob Riis wrote about documented and photographed the poor and destitute although not specifically homeless people in New York City tenements in the late 19th century.

It took a lil longer for him to sort out my claim because it was flagged as a pregnancy claim. San Mateo County CA. His book How the Other Half Lives published in 1890.

The higher the tax bracket you are in the more tax savings. - The Washington state House on Wednesday voted 91-6 to delay the implementation of the mandatory long-term. San Mateo County workers are scrambling to clean up a mess uncovered by the ABC7 I-Team.

Are you looking for a 401k savings guide. San Mateo County covers most of the San Francisco Peninsula that runs south from the Golden City. Years ago when I was just a little sapling starting out in the professional world I was given a W-4 form and asked to write down how many allowances I wanted.

The decision to contribute to a 401k or invest in an after-tax brokerage account is a dilemma that will be solved in this post. There are no national figures documenting homeless people demography at this time. The summer job is a rite of passage for many teenagers.

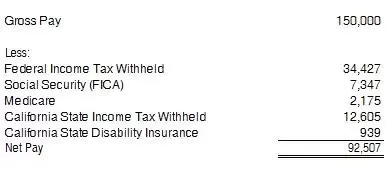

For example the city income tax in San Francisco is only 038 but that figure rises to as much as 85 in the District of Columbia. TSLA contract worker Owen Diaz 137 million in damages in October over racial abuse at the companys Fremont factory. The 401k is one of the most woefully light retirement instruments ever invented.

Joe Bidens national security adviser Jake Sullivan may have some explaining to do during his next press conference. As someone who has built up millions in both accounts there are some key considerations you need to make. Paper checks are so 2021.

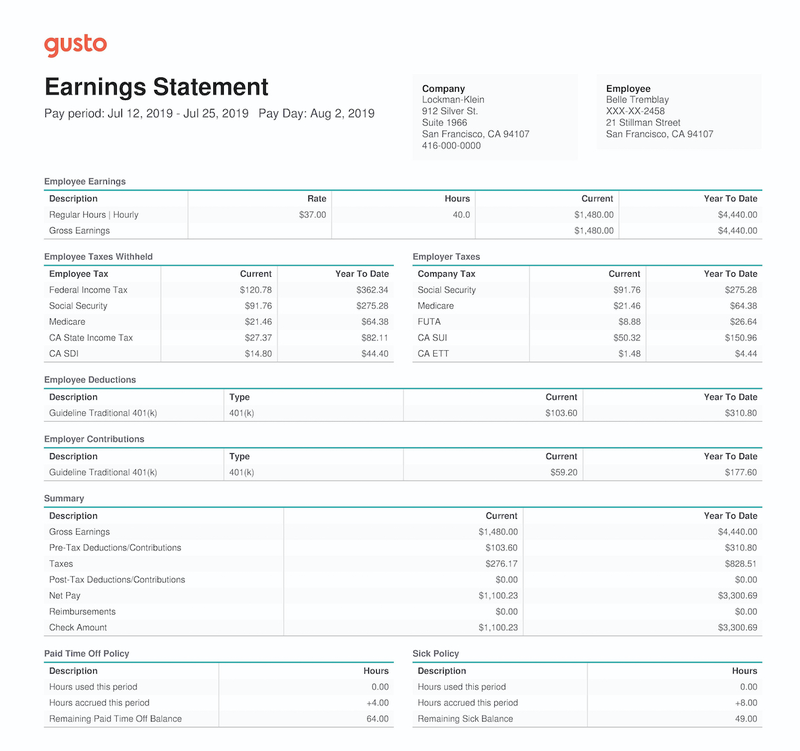

With the 2019 tax code 62 of your income goes toward social security and 29 goes toward medicare tax but if youre employed by a company full-time they pay half of your medicare responsibilities so you should only see 145 taken from. I logged into my Edd and there it was my payment. Once you reach the maximum taxable earnings currently 142800 for calendar year 2021 withholdings from your employer will discontinue resulting in a higher paycheck says Mike Biggica a certified financial planner and founder of.

I definitely worry a bit about living in San Francisco. Its the rash of super-potent synthetic opioids like fentanyl that are causing. So far I really like it here but everything is.

The catch-up contribution alone produced a tax discount of 1430. Call 213 992-3299 anytime. Its also worth noting that only the first 106800 of a persons.

Paycheck Amount biweekly. I was pregnant 2 years ago lol. But I had no idea what it meant or how it would affect my paychecks.

You can reduce the amount of taxes taken out of your paycheck by increasing your dependents reducing the amount of non-job income or. Looking at 1913 US national labor statistics the average baker in 1913 San Francisco worked 54 hrswk and made 046 per hour for an annual wage of 12912 or 33K in 2020 dollars The median baker in 2020 California makes 365Kyr 3. Currently I jump through the hoops needed to get paid so its not like Im demanding others step in to save me.

And it might involve his own role in perpetuating the Democrats myth about Donald Trumps alleged collusion with the Russians. The 385300 tax returns with income in this county earned nearly 604 billion. They can also put away 14000 into a Roth IRA at a 12 rate paying just 1680 in taxes to save a bit of.

I was told it was for tax purposes. -- Workers in Californias San Mateo County are scrambling to clean up a mess uncovered by our sister station in San Francisco KGO-TVs I. The maximum amount you can contribute is 20500 for 2022 up from 19500 in 2021.

Meanwhile state taxes run from just 29 in North Dakota to up to 123 in California. This post will go through how much I think you should have in your 401k by age in order to have a comfortable retirement in your 60s and beyond. So far I really like it here but everything is.

That leaves the county with a per-return income of 156700. I definitely worry a bit about living in San Francisco.

What Are Employee And Employer Payroll Taxes Ask Gusto

A Small Business Guide To Pay Stubs Examples The Blueprint

I Will Move To Silicon Valley And Earn 142k Year As Base Salary What Would My Monthly Take Home Pay Be After Taxes Quora

Here S How Much Money You Take Home From A 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary

7 Ways To Pay Your Rent When You Don T Have The Money How To Raise Money Rent Smart Money

What Is A Breakdown For Take Home Pay On A 120 000 Salary Living In San Francisco Quora

California Paycheck Calculator Smartasset

What America S Average Take Home Pay Looks Like Compared To Other Countries Mental Floss

I Make 120k Year In Bay Area But My Monthly Net Is 5700 What S Wrong Quora

Payroll Tax Vs Income Tax What S The Difference The Blueprint

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Different Types Of Payroll Deductions Gusto

New Tax Law Take Home Pay Calculator For 75 000 Salary

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Sweden Fitol Gas Utility Bill Template In Word Format Bill Template Templates Utility Bill