osceola county property tax payment

125 ACH electronic check fee. To begin please enter the appropriate information in one of the searches below.

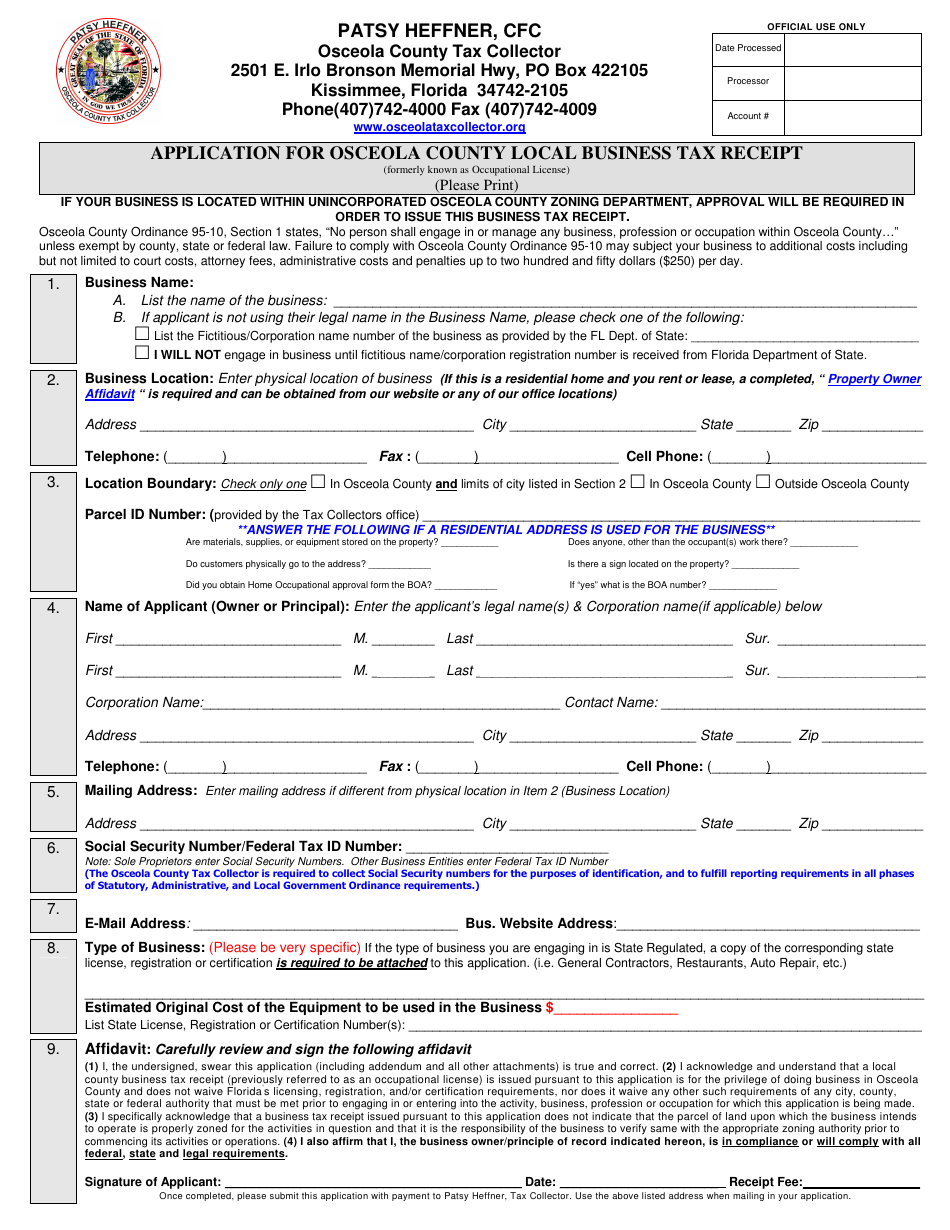

Fillable Online Osceola Business Tax Receipt Consolidated Application Commercial Osceola Fax Email Print Pdffiller

Before you do look at what the appraisal actually does to your annual real property tax bill.

. Irlo Bronson Memorial Hwy. Live Chat Available Mon-Fri 800AM-600PM Call 407-742-2900 to. The total rental charge is any fee or charge the guest must pay to occupy the rental property.

Under Florida law your. Ad Check the Current Taxes Value Assessments More. Search in Osceola County Now.

Your account number is your parcel number that begins with 67. Just a reminder that we will be closed Monday May 30 2021 in observance of Memorial Day and will reopen on Tuesday May 31 2021 at 8 am. The fee will be 185 of the total amount for paying with a credit card.

OSCEOLA COUNTY TAX COLLECTOR. Welcome to the Delinquent Tax Online Payment Service. Osceola County Tax Collector - Office of Bruce Vickers Serving our.

If you would like to pay when we are closed or prefer not to come inside we have a walk-up secured drop. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. Please contact the Collector office at 704 920-2119 to get your plan for payments.

I cant pay my property tax in full. We remember and honor those who served and sacrificed. Dont wait in line.

With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay. If you have to go to court it may make sense to get service of one of the best property tax attorneys in Osceola County IA. Search all services we offer.

OSCEOLA COUNTY TAX COLLECTOR. Winter taxes are due by February 14 without penalty. These taxes are due Monday February 28 2022 by 500pm.

Irlo Bronson Memorial Hwy. Irlo Bronson Memorial Hwy. You can report a playback problem to the Osceola County IT Department using one of the methods below.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Objecting to your real estate tax valuation is your right. Pay Property Taxes Online in Osceola County Michigan using this service.

Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. This service allows you to search for a specific record within the Delinquent Tax database to make a payment on. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

Osceola Tax Collector Website. Tangible Personal Property Tax. If you are contemplating taking up residence there or only planning to invest in Osceola County property youll learn whether the countys property tax laws are helpful for.

Discover the Current Taxes What the Osceola Cty Assessor Thinks the Land Is Worth. And the taxpayer will be required to pay the taxes due in full by March 31st. Please utilize our website whenever possible.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. The Tax Collectors Office provides the following services. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

Visit their website for more information. Make an appointment online and save valuable time. Calculate how much your actual tax payment will be with the.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. After 500pm After this time all unpaid taxes will be sent as delinquent to the Livingston County Treasurer. BSA Software provides BSA Online as a way for municipalities to display.

A taxpayer who chooses to pay taxes by the installment method will make quarterly payments based on an estimated tax equal to the actual taxes levied on the property in the prior year. Taxpayers may also make property tax. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523.

What do I do. The Tourist Development Tax is a charge on the total rental amount charged to a guest for any short term rental less than 180 days. Section 197222 FS allows a taxpayer to prepay property taxes by an installment payment method.

If the owner fails to pay hisher taxes a tax certificate will be sold by the Tax Collector. When are taxes due. Summer taxes are due by September 14 without interest.

If you are unable to pay your tax in full then you can make partial payments. You can talk to a live agent to pay with eCheck credit or debit card. PAY TAXES RENEW YOUR TAGS AND MUCH MORE.

Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest. Tourist Development Tax Osceola County Code of Ordinances Chapter 13 Article III Tourist Development Tax.

Residents Happy Memorial Day from all of us at the Property Appraisers office. The easiest way to file your tourist tax returns online. Osceola County Clerk of the Circuit Court Kelvin Soto 2 Courthouse Square Kissimmee Florida 34741 407 742-3500.

Tonia Hartline 301 W. The 2021 Winter Tax bills were mailed Wednesday December 1st 2021. Taxpayers can call Personal Teller at 877-495-2729.

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser 2505 E Irlo Bronson Memorial Hwy Kissimmee Fl 34744 Usa

Property Search Osceola County Property Appraiser

Property Tax Search Taxsys Osceola County Tax Collector

Job Opportunities Osceola County Job Center

Osceola County Forms Form Ead Faveni Edu Br

Osceola County Property Appraiser How To Check Your Property S Value

Osceola Property Appraiser Fill Online Printable Fillable Blank Pdffiller

Osceola County Property Appraiser 2505 E Irlo Bronson Memorial Hwy Kissimmee Fl 34744 Usa