cook county back taxes

More than half owe less than 1000 in back taxes Learn More. Property Index Number PIN taxpayer name property address mailing address amount of taxes due property classification and whether tax bills or notices were.

Cook County Land Bank Authority Rescued Josephine S Cooking In Chatham From Tax Sale Then Hosted An Event There Chicago Sun Times

WATCH LIVE Chicago Suburban Cook Co.

. Ad We Help Taxpayers Get Relief From IRS Back Taxes. Nov 5 2021 12800 PM. Hotels and shopping malls have skipped out on their Cook County tax payments Pummeled by the pandemic numerous hotels and shopping malls in Cook County have.

Step 1 Existing Homeowners. Determine if your exemption s will automatically renew this year or if. Cook County Gun Ammo Tax May Be Back Soon.

On October 21 2021 the IL Supreme Court struck down the. The lawsuit challenged Chicagos city ordinance imposing a 9 amusement tax on subscription streaming entertainment products such as those offered by Netflix Hulu and. Search Cook County Records Online - Results In Minutes.

Gun Control News Politics Current Events. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. To see if your taxes have been sold forfeited or open for prior years currently defined as 2019 and earlier please enter your property index number PIN in the search box below.

We need to get this money back to people that. Clark Street Room 230 Chicago IL 60602. A search box will pop up in the top right corner of your browser and you could type in that search box and it will locate the text youre typing on the page.

View a simple reference guide to understand the mail from our office. Landlords owe Cook County nearly 200 million in commercial property taxes from part of 2019 and another 11 billion from all of last year according to Crains. Cook County property tax refunds remain unclaimed with Treasurer Maria Pappas saying it amounts to more than 100 million.

Bruce Finkelman a managing partner in 16 on Center the development. Plus the Illinois Department of. If you live in a county with 3000000 or more residents.

It involves the Assessors Office the Board of Review the Cook County Clerk and the Cook County Treasurer. Any payments made on or before October 1 for property tax second installments will be considered filed and paid on time by Cook County Treasurer Maria Pappas. The mailing of the bills is.

The Tax Year 2021 Second Installment Property Tax due date has yet to be determined. Cook County is attempting to collect hundreds of thousands of dollars in back taxes from several small Chicago music venues claiming that the establishments should not. To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer.

It amounts to about 100000 in taxes owed and about another 100000 in interest and penalties. Ad Stand Up To The IRS. The rebates will be sent automatically to residents who filed 2021 state income taxes and claimed a property tax credit.

Ad Find Cook County Online Property Taxes Info From 2022. The 2022 Scavenger Sale includes 31209 property index numbers or PINs with 14598 of them in the City of Chicago and 16611 in suburban Cook County. Based On Circumstances You May Already Qualify For Tax Relief.

Two years ago the assessor granted the senior freeze for 144904 properties which shifted 250 million in property taxes from them onto Cook Countys other 177 million. Cook County Treasurers Office - Chicago Illinois TAX BILL UPDATE. Cook County property tax bills will be due before the end of the year board President Toni Preckwinkle announced Thursday afternoon along with a plan to help towns.

At any time on or before the business day immediately before the sale you can pay the taxes and costs due which will stop the sale. Cook County IL currently has 48688 tax liens available as of September 13. Yarbrough Cook County Clerk 118 N.

More than 37000 properties will be part of Cook Countys Tax Sale running from May 12th to 18th. NEW 1182021 - Firearm and Firearm Ammunition Tax must be collected beginning November 15 2021 On November 4 2021 the Cook County Board of. If you have any issues please call our.

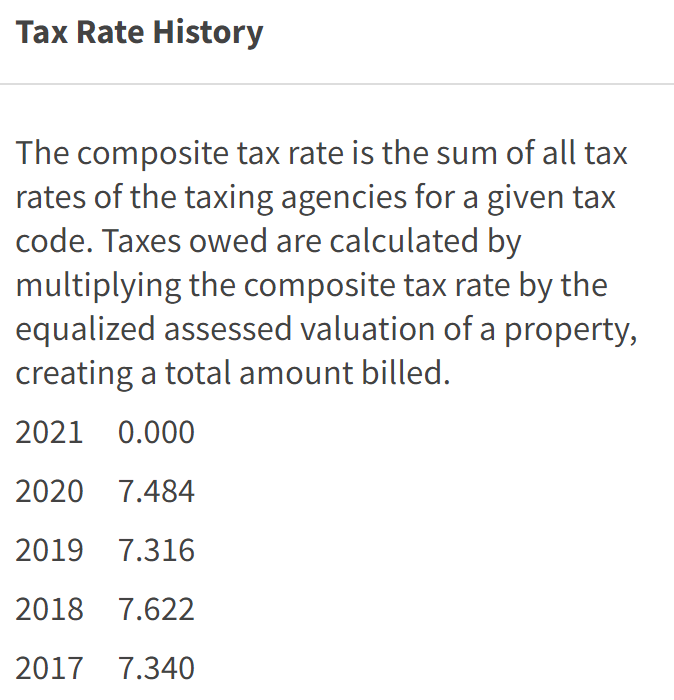

The Cook County property tax system is complex.

How To Find Tax Delinquent Properties In Your Area Rethority

Amish School Shooting Amish School Shooting Amish Amish Culture

Cook County 2nd Installment 2021 Tax Bills Delayed Lp

Toll Brothers America S Luxury Home Builder Beautiful Backyards Modern Craftsman Home House In The Woods

Illinois Income And Property Tax Rebate How To Know If You Re Eligible Nbc Chicago

Zenith Vending Taxes On Cigarettes 1 09 Per Pack 20 Strike Matchbook Cover Ebay In 2022 Matchbook Cover Zenith

Eric Muhr On Twitter Nursing Home Nurse Long Term Care

For The Love Of Cross Stitch Magazine 24 Cross Stitch Patterns September 2002 Ebay Cross Stitch Magazines Cross Stitch Cross Stitch Patterns

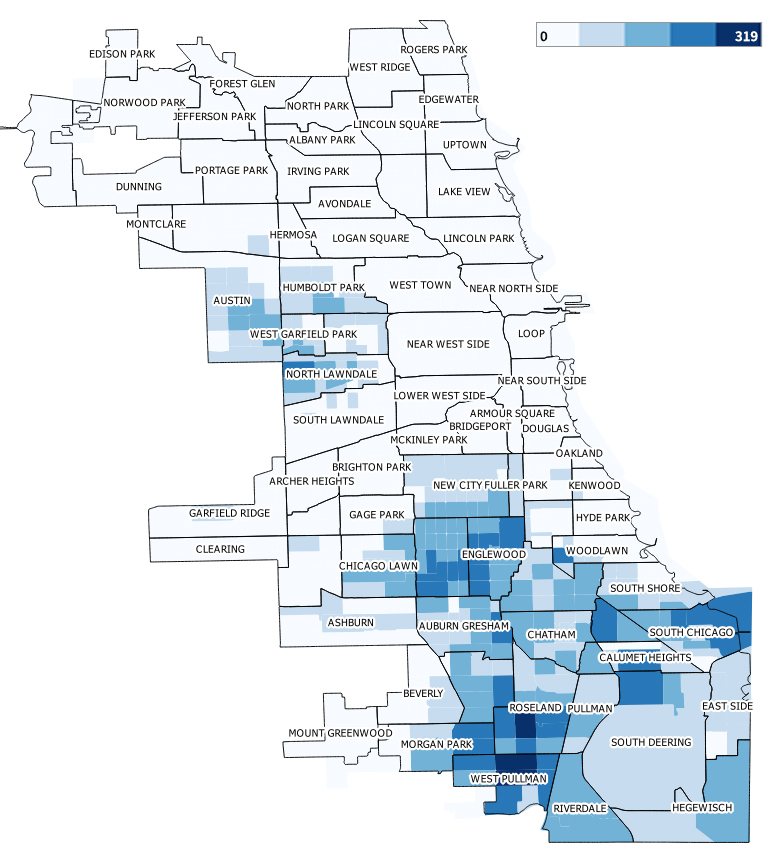

Racial Inequality Broken Property Tax System Blocks Black Wealth Building Bloomberg

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Homebuyer Seller Investor 2013 Tax Time Costs I Can Not Deduct Property Tax Tax Time Tax

How To Appeal Your Cook County Property Taxes The Details Income Tax Property Tax Tax Attorney

How To Find Tax Delinquent Properties In Your Area Rethority

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

How To Find Tax Delinquent Properties In Your Area Rethority

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Property Tax Portal

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr